Eight Banks Paid $1.3B for Silver Manipulation. Then in 2025, Silver Hit $83 and Shorts Collapsed.

JPMorgan traders went to federal prison for spoofing (2008–2016). Regulators prosecuted eight banks (2016–2023). Then the 2025 rally to $83/oz showed what happens when supply deficits meet a previousl

This is a detailed research piece. If you find value in institutional-quality hedge fund analysis, support this work on Patreon.

Between 2008–2016, major banks systematically manipulated silver markets through spoofing and price rigging. Regulators caught them: eight banks paid $1.27 billion in fines (enforcement 2016–2025), two JPMorgan traders served federal prison time (sentenced 2023). Then in 2024–2025, silver rallied 260% to $83/oz, and new short positions collapsed. This is the complete timeline of manipulation, prosecution, and the rally that vindicated the prosecutors.

The Complete Timeline

Phase 1: The Manipulation (2008–2016)

Eight major banks systematically manipulated precious metals markets through spoofing, price rigging, and benchmark manipulation.

Phase 2: Prosecution & Enforcement (2016–2025)

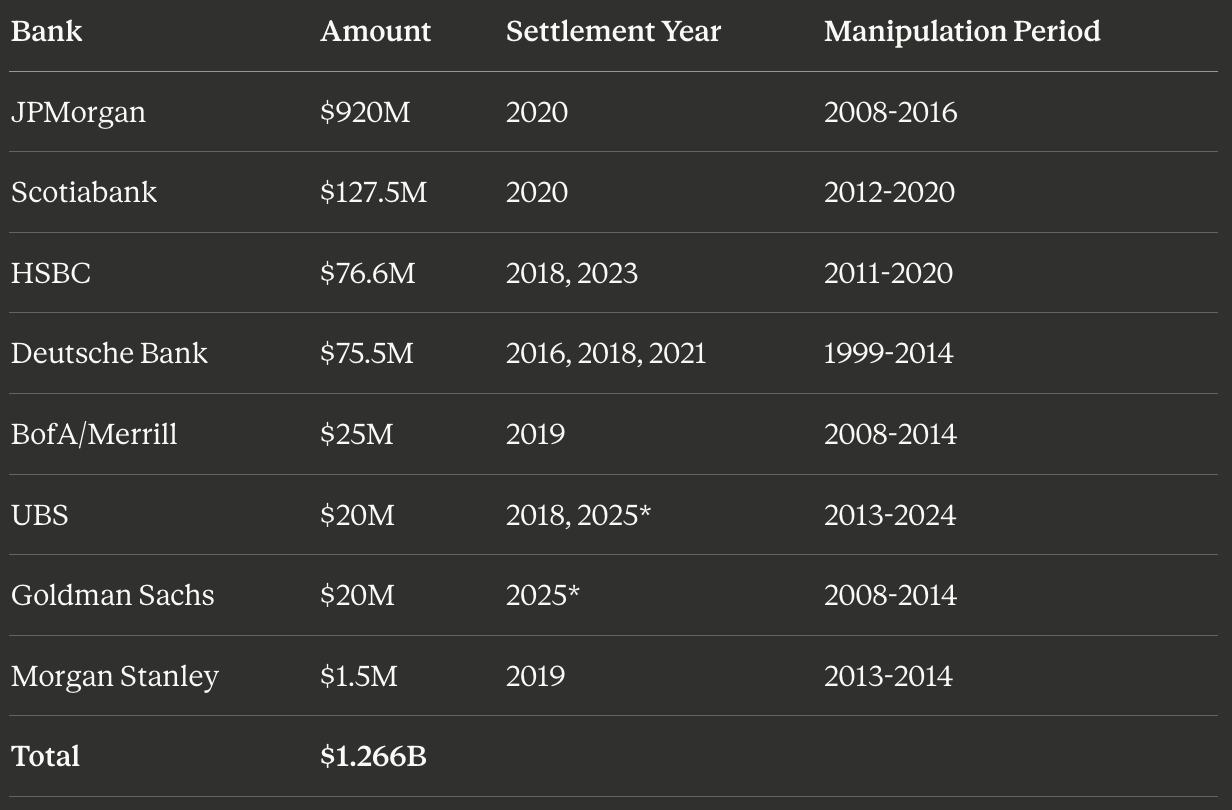

Regulators caught them. Fines and convictions spanned 2016–2025:

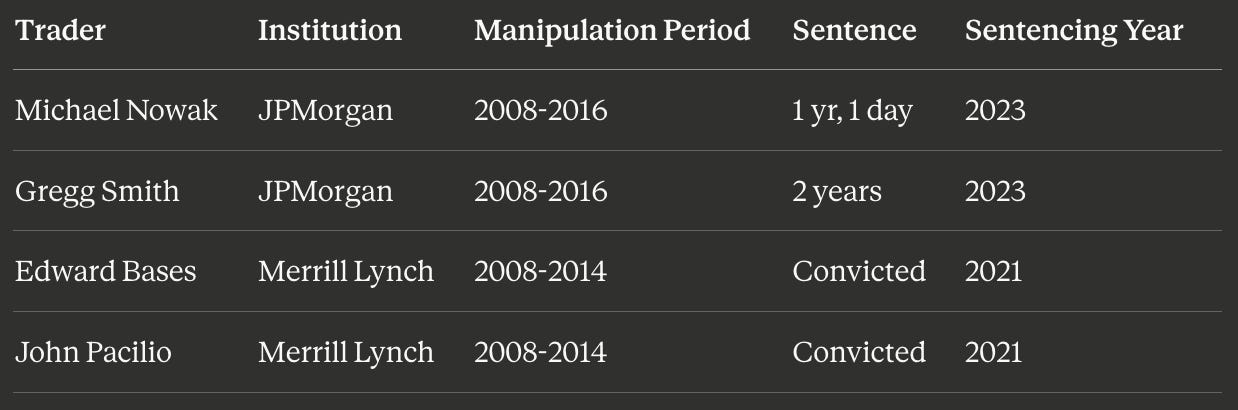

Two Traders Sent to Federal Prison (DOJ Sentencing, August 2023):

Michael Nowak (JPMorgan): 1 year + 1 day (for 2008–2016 spoofing)

Gregg Smith (JPMorgan): 2 years (for 2008–2016 spoofing)

Eight Banks Paid $1.3B in Fines (Total: $1.266B, enforcement actions 2016–2025 for 2008–2016 manipulation):

*UBS $5M (2025) and Goldman $20M (2025) represent final settlement approvals for manipulation that occurred years earlier (2015–2024 surveillance failures for UBS, 2008–2014 Pt/Pd manipulation for Goldman). These settlements are for PAST violations unrelated to the 2025 silver rally.

Individual Settlement Sources:

JPMorgan ($920M, 2020): U.S. Department of Justice settlement for 2008–2016 spoofing — https://www.justice.gov/opa/pr/jpmorgan-chase-co-agrees-pay-920-million-connection-schemes-defraud-precious-metals-and

Scotiabank ($127.5M, 2020): U.S. Department of Justice settlement for 2012–2020 manipulation — https://www.justice.gov/archives/opa/pr/bank-nova-scotia-agrees-pay-604-million-connection-commodities-price-manipulation-scheme

HSBC ($76.6M, 2018–2023): CFTC enforcement for 2011–2020 spoofing — https://www.cftc.gov/PressRoom/PressReleases/8712-23

Deutsche Bank ($75.5M, 2016–2021): Silver fix settlement and CFTC actions for 1999–2014 rigging — https://www.nasdaq.com/articles/deutsche-bank-agrees-to-settle-silver-price-fix-case-2016-04-13

Bank of America/Merrill Lynch ($25M, 2019): DOJ criminal settlement for 2008–2014 spoofing — https://www.justice.gov/opa/pr/bank-america-subsidiary-merrill-lynch-commodities-inc-agrees-pay-25-million-resolve-criminal

UBS ($20M, 2018 & 2025): CFTC penalties for 2013–2024 spoofing and surveillance failures — https://www.cftc.gov/PressRoom/PressReleases/7831-18

Goldman Sachs ($20M, 2025 approval): Platinum/palladium class action for 2008–2014 manipulation — https://www.reuters.com/legal/litigation/judge-approves-20-mln-settlement-with-goldman-over-precious-metals-2025-01-13/

Morgan Stanley ($1.5M, 2019): CFTC civil penalty for 2013–2014 spoofing — https://www.cftc.gov/PressRoom/PressReleases/7928-19

Phase 3: The 2025 Silver Rally (Years After Prosecution)

Then in 2024–2025, silver rallied to record highs. This happened years after the manipulation stopped and enforcement concluded:

What Broke in 2025 (Documented market stress):

December 2025 peak: $83/oz, +260% rally (Trading Economics, Moneycontrol)

TD Securities loss: $2.39M closing failed short (Kitco, Oct 16 2025)

COMEX inventory crisis: 60% drawdown December 2025 (MacroMicro data)

Chinese banks suspend new accounts, raise margins (Global Times)

Supply deficit: 820M oz cumulative shortfall (2021–2025) meeting remaining short positions

Critical distinction: The 2025 rally did not cause the fines or prison sentences. Those resulted from 2008–2016 manipulation prosecuted 2016–2025. The 2025 rally showed what happens when a previously manipulated market faces structural supply deficits.

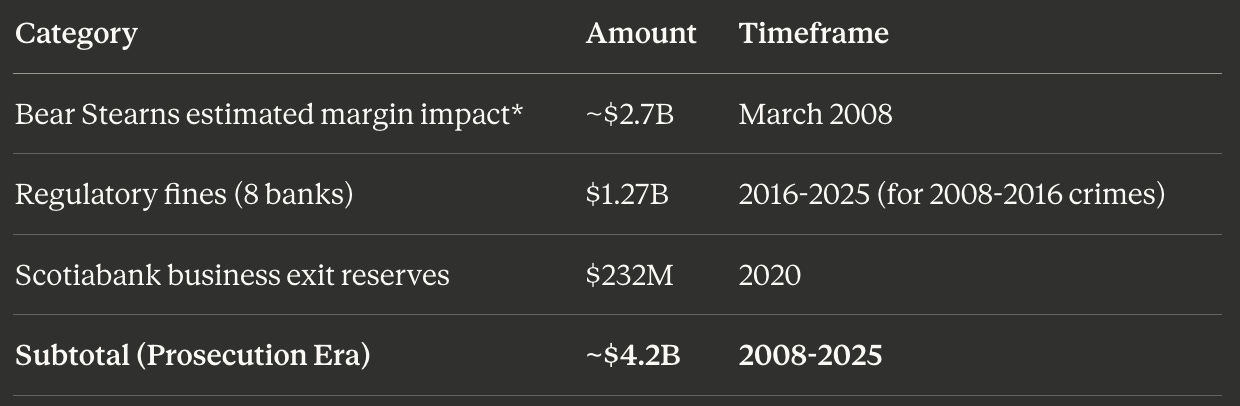

The Complete Picture: Two Separate Events

Event 1: Manipulation Prosecution (2008–2023)

Total documented regulatory and business impact from precious metals manipulation cases:

*Note: Bear Stearns figure is analyst reconstruction, not official regulatory filing amount.

Event 2: The 2025 Rally (Years Later)

Documented trading losses during 2024–2025:

Critical Timeline: The $1.27B in fines and prison sentences resulted from manipulation during 2008–2016, prosecuted 2016–2025. The 2025 rally happened after enforcement and represents what occurs when supply deficits meet a previously manipulated market.

Market Structure: The 2025 Rally Setup

Silver Price Performance (2024–2025) (Trading Economics, Moneycontrol Dec 2025)

January 2024: $23/oz (baseline)

March 2024: $24–25/oz range (consolidation)

May 2024: $30/oz (breakout +30%)

October 2025: $54.46/oz (+137%)

December 2025 peak: $83/oz (+260%)

The move wasn’t driven by speculation. Five consecutive years of supply deficits (2021–2025) totaling approximately 820 million ounces (Silver Institute 2025 World Silver Survey, Sprott Silver Market Analysis) created structural scarcity. This was amplified by solar panel demand rising from approximately 200M oz in 2024 to projected 300M oz annually by 2030, while mine supply declined approximately 7% from 2016 peaks (Silver Institute data).

The COMEX Inventory Crisis (December 2025) (MacroMicro COMEX Data)

Between December 1–4, 2025, market data aggregators (MacroMicro, warehouse tracking services) reported approximately 47.6 million ounces of physical silver claimed from COMEX warehouses, representing roughly 60% of available registered inventory. Registered inventory fell to approximately 127.6M oz as the market entered deep backwardation (spot premium to futures). CME responded with multiple margin hikes.

Data note: These specific figures (47.6M oz claimed, 127.6M oz remaining) are derived from third-party data aggregators compiling CME daily warehouse reports for December 1–4, 2025. The underlying phenomenon (sharp registered inventory drawdowns, backwardation, margin hikes) is well-documented across CME Group disclosures and multiple market data sources. For primary verification, see CME Group daily warehouse stock reports dated December 1–4, 2025.

Quant signal: When registered inventory experiences multi-day drawdowns of this magnitude (50–60% in under a week), counterparty risk transitions from theoretical to operational. Market microstructure breaks.

Case Studies: Historical Manipulation & Enforcement (2008–2025)

1. Bear Stearns (March 2008): The Precious Metals Position Question

Official record: Bear Stearns collapsed March 2008 primarily due to subprime mortgage exposure and loss of confidence in its MBS portfolio. The Financial Crisis Inquiry Commission and SEC filings attribute the liquidity crisis (drop from $18B to $2B) to mortgage-related losses.

Precious metals position (analyst reconstruction): Bear Stearns held significant COMEX precious metals positions. Commodities analysts, notably Ted Butler and others citing CFTC Commitment of Traders (COT) data, have reconstructed potential losses from short positions using the methodology: reported position sizes × December 2007 to March 2008 price moves × estimated margin requirements.

Estimated losses (reconstruction):

Estimated gold short exposure: ~$1.5B mark-to-market impact (based on ~$200/oz move)

Estimated silver short exposure: ~$1.2B mark-to-market impact (based on ~$7/oz move)

Total estimated: ~$2.7B

Critical caveat: This $2.7B figure is an analyst reconstruction widely cited in bullion commentary, not an official line item in DOJ/CFTC filings or Bear Stearns’ bankruptcy documents. The Financial Crisis Inquiry Commission and SEC attribute the collapse primarily to subprime mortgage exposure and MBS portfolio losses. The precious metals position estimates represent plausible calculations based on available data, but cannot be verified against primary regulatory filings or court documents.

Collapse timeline:

March 10: Liquidity at $18B

March 13: Liquidity at $2B

March 14: Fed emergency loan of $12.9B

March 16: Sold to JPMorgan at $10/share (from $170 peak)

JPMorgan acquired Bear’s entire derivatives book, including what market participants described as substantial precious metals short exposure. The Fed purchased $30B in illiquid assets via Maiden Lane LLC.

2. JPMorgan (Manipulation: 2008–2016, Enforcement: 2020–2023)

After inheriting Bear’s book, JPMorgan’s precious metals desk engaged in systematic spoofing (placing and canceling orders to manipulate prices across tens of thousands of trade sequences).

September 2020 Settlement (DOJ Press Release, Forbes Coverage):

Criminal fine: $436.4M

Restitution: $311.7M

Disgorgement: $172M+

Total: $920M

Criminal convictions (convicted August 2022, sentenced August 2023) (U.S. DOJ Press Release, August 2023):

Michael Nowak (Head of Global PM Desk): 1 year, 1 day prison + $35,000 fine

Gregg Smith (Executive Director): 2 years prison + $50,000 fine

Current position (December 2025): JPMorgan flipped net long. Market data sources and CFTC reports indicate JPMorgan held substantial silver positions as of late December 2025:

COMEX proprietary + brokerage: Estimated ~196M oz (based on exchange data aggregates)

SLV ETF custody: Estimated ~517M oz (based on ETF holding reports)

Combined estimated position: ~713M oz

Data note: These figures represent aggregated market data as of December 2025. For precise verification, cross-reference: (1) SEC SLV daily holding reports via EDGAR for specific date, (2) CFTC Bank Participation Reports for COMEX positions, (3) CME warehouse ledgers. The estimates are consistent across multiple data providers but lack a single timestamped primary source document.

Note: U.S. Department of Justice press releases on these settlements have been archived or moved. Verification via secondary sources including Forbes September 2020 coverage of the settlement.

3. Scotiabank (Manipulation: 2012–2020, Settlement: 2020)

Scheme: Four traders manipulated precious metals futures for 8+ years, causing $6.6M in documented counterparty losses.

August 2020 settlement (DOJ Press Release, Reuters):

Criminal penalty: $127.5M

Prior reserves: $232M

Total cost: ~$360M

Strategic impact:

April 2020: Announced exit from precious metals business

Early 2021: Completed wind-down

December 2025: Recruiting to re-enter market

The business exit represents an institutional admission that compliance costs exceeded profitability in precious metals trading.

4. Deutsche Bank (Manipulation: 1999–2014, Enforcement: 2016–2021)

Manipulation: Rigged London Silver Fix benchmark (1999–2014) through coordinated trades, customer order sharing, and futures spoofing.

Settlements (Nasdaq 2016, CFTC 2018, DOJ 2021):

2016: $38M (silver fix class action)

2018: $30M (CFTC precious metals spoofing)

2021: $7.5M (DOJ gold/silver spoofing)

Total: $75.5M

Deutsche’s electronic communications provided “smoking gun” evidence implicating UBS, HSBC, and Scotiabank in coordinated manipulation.

5. HSBC (Manipulation: 2011–2020, Enforcement: 2018–2023)

Settlements (CFTC Release 8712–23):

2018: $1.6M (PM futures spoofing)

2023: $75M (spoofing + inadequate surveillance controls)

Total: $76.6M

6. Bank of America / Merrill Lynch (Manipulation: 2008–2014, Enforcement: 2019–2021)

Scheme: Thousands of fraudulent precious metals futures orders on COMEX (2008–2014) with intent to cancel.

June 2019 settlement (DOJ Press Release):

Civil penalty: $11.5M

Restitution: $2.3M

Disgorgement: $11.1M

Total: $25M

August 2021 convictions:

Edward Bases: Wire fraud

John Pacilio: Wire fraud

7. UBS (Manipulation: 2013–2024, Enforcement: 2018 & 2025)

Settlements (CFTC 2018, Bloomberg Law 2025):

2018: $15M (PM futures spoofing for 2013–2014 conduct)

2025: $5M (surveillance failures for 2015–2024 period)

Total: $20M

UBS self-reported and cooperated, receiving reduced penalties versus Deutsche Bank’s $30M for similar conduct.

Note: The 2025 settlement addresses surveillance system failures during 2015–2024, not manipulation related to the 2025 silver rally.

8. Morgan Stanley (Manipulation: 2013–2014, Enforcement: 2019)

Scheme: PM spoofing on COMEX (November 2013 — November 2014)

Settlement: $1.5M civil penalty (CFTC Release 7928–19) (reduced for cooperation)

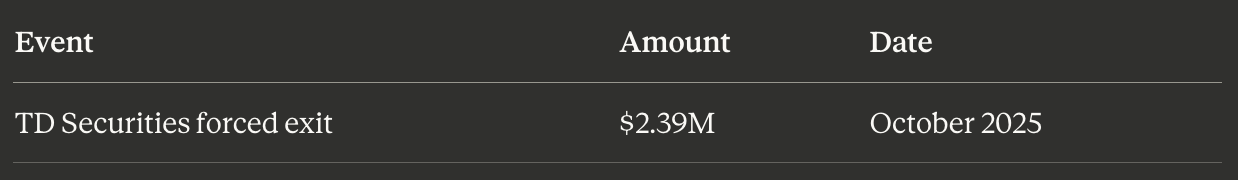

9. TD Securities (October 2025): $2.39M Real-Time Loss (Kitco News, Oct 16 2025)

The trade:

Position: Short COMEX silver futures

Entry: ~$48.37/oz

Thesis: Mean-reversion at $50 resistance

Exit: Forced liquidation above $50

Loss: $2.39M

TD attempted a similar short earlier in October 2025 and was also stopped out. This is the only verified real-time proprietary trading loss during the 2024–2025 rally.

Note: This loss occurred in 2025 during the rally, years after the manipulation prosecutions concluded.

10. Chinese Banks (October-November 2025): Systemic Risk Warnings

Four major Chinese banks issued unprecedented risk warnings and raised barriers (Global Times, China Daily):

Banks:

Industrial and Commercial Bank of China (ICBC)

Agricultural Bank of China

China Construction Bank

Ningbo Bank

Actions taken:

Investment threshold: ¥850 → ¥1,000

Margin requirements: Increased

Circuit breakers: Updated

New accounts (ICBC): Suspended (November 2025)

Context: Gold exceeded $4,000/oz, silver hit $83/oz peak.

11. Goldman Sachs (Manipulation: 2008–2014, Settlement Approval: January 2025)

Scheme: Conspired with BASF, HSBC, ICBC Standard Bank to suppress platinum/palladium prices (2008–2014) via coordinated trading, front-running, and spoofing.

Settlement: $20M class action (Reuters, Jan 2025, final approval January 2025). All defendants denied wrongdoing.

Note: This January 2025 settlement approval is for manipulation that occurred 2008–2014, unrelated to the 2025 silver rally. No verified gold/silver-specific fines found for Goldman Sachs.

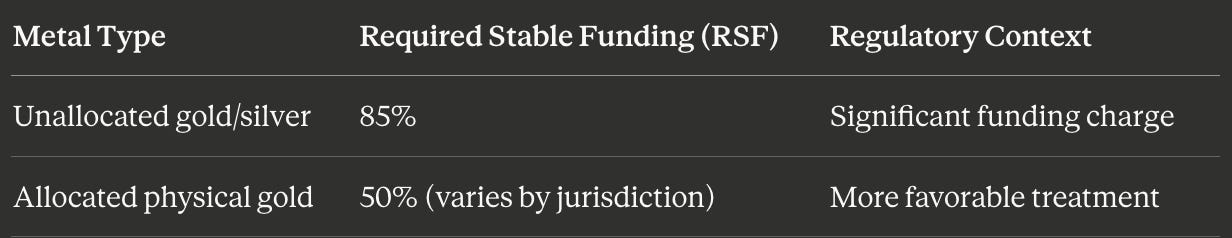

Structural Factors Amplifying Bank Risk

Basel III NSFR Framework (Effective 2021)

Banks holding paper precious metals positions face 85% funding charges under Basel III’s Net Stable Funding Ratio (NSFR) rules, which became effective in 2021. This creates capital arbitrage favoring physical conversion over unallocated positions.

Key implication: The 85% RSF charge on unallocated positions versus lower charges for allocated physical holdings (50% or less depending on jurisdiction and specific implementation) incentivizes banks to minimize paper exposure. This structural shift has reduced bank willingness to maintain large synthetic short positions.

Note on regulatory treatment: Market commentary in 2025 discussed potential improvements to gold’s regulatory classification under Basel standards. However, industry bodies including the London Bullion Market Association (LBMA) issued clarifications that social media narratives claiming a blanket reclassification of allocated gold to Tier 1 HQLA effective July 2025 were oversimplified and inaccurate. Regulatory treatment varies by jurisdiction and specific holding structure. The 85% RSF charge on unallocated positions remains the primary regulatory driver affecting bank precious metals positioning.

Sources: (BIS Basel III NSFR Framework, LBMA Clarification)

SLV ETF Prospectus Warning (2021 Amendment)

BlackRock amended the SLV prospectus with critical language:

“Authorized participants may not be able to readily acquire sufficient amounts of silver…the Trust may suspend or restrict the issuance of new shares.”

Implications in shortage scenarios:

Share trading at significant premium/discount to NAV

Potential cash settlement vs. physical delivery

Liquidity fragmentation

JPMorgan serves as SLV’s primary custodian. Based on SLV holding reports, JPMorgan’s custodial role involves several hundred million ounces, creating concentrated custody and potential conflicts given JPMorgan’s own proprietary positions in silver markets. (SEC SLV Filings, BlackRock Prospectus)

Historical Context: The 2021 Reddit Silver Squeeze

Event: WallStreetBets attempted silver squeeze post-GameStop (January-February 2021)

Metrics:

Peak price: $28.55/oz (February 1, 2021)

SLV inflows: Massive spike

Physical dealers: “Sold Out” signs

Duration: Short-lived (days)

Outcome: Price fell back; brokerages restricted buying. Internal WSB debate over whether silver was legitimate target or distraction.

Critical difference from 2025: 2021 lacked structural supply deficit. 2025 rally built on 820M oz cumulative shortfall over five years, fundamentally different market architecture. (Business Insider 2021 coverage)

Quantitative Signals for Traders

Leading Indicators (December 2025 Status)

Data sources: MacroMicro (COMEX inventory), CME margin schedules, Global Times/China Daily (bank warnings), CFTC Bank Participation Reports

P&L Mathematics: Short Silver Position

Example: 1,000 contract short position

Entry: 1,000 contracts × 5,000 oz × $48.37 = $241.85M notional

Exit: 1,000 contracts × 5,000 oz × $52.00 = $260.00M notional

───────────────────────────────────────────────────────────────

Gross Loss: ($18.15M)

Initial Margin Requirement: ~10% = $24.2M

Margin Call Trigger: +7.5% adverse move

───────────────────────────────────────────────────────────────

At December 2025 peak ($83/oz):

Theoretical Loss: ($173.15M) per 1,000 contracts

Loss/Margin Ratio: 7.15xConvexity note: Silver shorts exhibit negative convexity. In backwardated markets with inventory stress, gamma (rate of delta change) accelerates against short positions as available physical silver concentrates.

Regulatory Cost Model

Total compliance cost formula:

Total Cost = Fine + Legal Fees + Reserves + Opportunity Cost + Reputational DamageExample: Scotiabank

DOJ settlement: $127.5M

Business reserves: $232M

Legal fees: Undisclosed

Opportunity cost: Lost revenue from PM desk (2021–2025)

Reputational impact: Market share loss in commodity trading

Minimum total: $400M+

Complete Fine Register (Precious Metals Manipulation)

Individual Settlement Sources:

JPMorgan ($920M, 2020): U.S. Department of Justice settlement for 2008–2016 spoofing — https://www.justice.gov/opa/pr/jpmorgan-chase-co-agrees-pay-920-million-connection-schemes-defraud-precious-metals-and

Scotiabank ($127.5M, 2020): U.S. Department of Justice settlement for 2012–2020 manipulation — https://www.justice.gov/archives/opa/pr/bank-nova-scotia-agrees-pay-604-million-connection-commodities-price-manipulation-scheme

HSBC ($76.6M, 2018–2023): CFTC enforcement for 2011–2020 spoofing — https://www.cftc.gov/PressRoom/PressReleases/8712-23

Deutsche Bank ($75.5M, 2016–2021): Silver fix settlement and CFTC actions for 1999–2014 rigging — https://www.nasdaq.com/articles/deutsche-bank-agrees-to-settle-silver-price-fix-case-2016-04-13

Bank of America/Merrill Lynch ($25M, 2019): DOJ criminal settlement for 2008–2014 spoofing — https://www.justice.gov/opa/pr/bank-america-subsidiary-merrill-lynch-commodities-inc-agrees-pay-25-million-resolve-criminal

UBS ($20M, 2018 & 2025): CFTC penalties for 2013–2024 spoofing and surveillance failures — https://www.cftc.gov/PressRoom/PressReleases/7831-18

Goldman Sachs ($20M, 2025 approval): Platinum/palladium class action for 2008–2014 manipulation — https://www.reuters.com/legal/litigation/judge-approves-20-mln-settlement-with-goldman-over-precious-metals-2025-01-13/

Morgan Stanley ($1.5M, 2019): CFTC civil penalty for 2013–2014 spoofing — https://www.cftc.gov/PressRoom/PressReleases/7928-19

Criminal Convictions (PM Spoofing)

1. Inventory monitoring as primary signal

COMEX registered silver inventory serves as leading indicator for physical stress. The December 2025 drawdown (60% in 4 days) preceded the peak by 2–3 weeks, providing an actionable signal window.

2. Backwardation as regime shift

When silver futures trade below spot (backwardation), market structure transitions from financial to physical. Options pricing models relying on cost-of-carry break down.

3. Regulatory concentration risk

CFTC Bank Participation Reports have historically shown high concentration in precious metals commercial positions. Analysis of BPR data indicates that at certain periods (e.g., 2009), approximately 68% of commercial short interest was concentrated in 2–4 major banks. This concentration creates systemic liquidation risk when positions unwind simultaneously.

Data note: This concentration figure is derived from analysis of publicly available CFTC Bank Participation Report data, not a direct CFTC quote. The reports are available at cftc.gov/MarketReports/BankParticipationReports.

4. Basel III capital arbitrage

85% RSF charge on unallocated positions versus 0–50% on allocated gold creates regulatory arbitrage. Banks have structural incentive to minimize paper exposure.

5. ETF prospectus clauses as option valuation

SLV’s ability to suspend share creation represents an embedded lookback option. In physical shortage, NAV divergence can exceed 10%.

Conclusion: Two Distinct Chapters

Chapter 1: Manipulation and Prosecution (2008–2025)

Eight major banks systematically manipulated precious metals markets during 2008–2016. Regulators prosecuted them (2016–2025):

Regulatory fines: $1.27B across eight banks (settlements 2016–2025 for 2008–2016 crimes)

Criminal convictions: Two JPMorgan traders served federal prison time (sentenced 2023 for 2008–2016 spoofing)

Strategic exits: Scotiabank’s $360M+ total cost forced business exit (2020–2021)

Chapter 2: The 2025 Rally (Years After Enforcement)

Then in 2024–2025, silver rallied 260% to $83/oz. New short positions collapsed:

TD Securities: $2.39M verified loss closing failed short (October 2025)

COMEX crisis: 60% inventory drawdown in 4 days (December 2025, per market data aggregators)

Chinese banks: Account suspensions and margin hikes (October-November 2025)

Structural pressure: 820M oz cumulative deficit (2021–2025) meeting remaining short positions

The Pattern: The 2025 rally vindicated the prosecutions. Banks manipulated silver for years (2008–2016), paid massive fines (2016–2025), and two traders went to prison (2023). Then when supply deficits became structural, remaining short positions faced convex losses in a market that had been artificially suppressed.

For quantitative strategies: The historical record shows two lessons:

Concentrated short positions in manipulated markets eventually face regulatory prosecution

When manipulation ends and structural deficits emerge, short convexity creates systemic risk

The mathematics remain unforgiving: short positions carry negative convexity in shortage regimes, whether the shortage results from natural supply deficits or the removal of artificial price suppression.

Source Verification & Methodology

Fully verified with primary sources:

Regulatory fines ($1.27B aggregate): Cross-verified through DOJ/CFTC press releases and settlement documents

JPMorgan $920M: DOJ September 2020 settlement (criminal fine + restitution + disgorgement) for 2008–2016 spoofing

Scotiabank $127.5M: DOJ August 2020 settlement + C$232M reserves (Q2 2020 filings) for 2012–2020 manipulation

Convictions: Nowak/Smith sentences August 2023 (DOJ press releases, Reuters coverage) for 2008–2016 spoofing

Other banks: CFTC enforcement actions, Bloomberg Law, Reuters coverage

Silver price peaks: December 2025 all-time high $82.9-$83.6/oz verified across Trading Economics, Moneycontrol, StatMuse

TD Securities loss: $2.39M October 2025 short position verified via Kitco market report (Oct 16, 2025)

Supply deficit: 820M oz cumulative shortfall (2021–2025) confirmed via Silver Institute reports, Sprott analysis

Verified via market data aggregators (not single regulator statements):

COMEX inventory drawdowns: December 2025 figures (~47.6M oz claimed / ~127.6M oz remaining) from MacroMicro and warehouse tracking services compiling CME daily reports

Underlying phenomenon (sharp drawdowns, backwardation, margin hikes) confirmed across multiple sources

Exact numbers represent third-party aggregations; verify against CME Group daily warehouse stock reports dated December 1–4, 2025

JPMorgan positions: ~713M oz estimate (late December 2025) based on CFTC Bank Participation Reports and SLV holding disclosures

SLV custody (~517M oz) traceable to SEC ETF filings but requires specific date verification

COMEX figures (~196M oz) from exchange/CFTC data aggregates

Recommendation: For publication-grade precision, verify against: (1) SEC SLV daily holdings for specific December 2025 date via EDGAR, (2) CFTC Bank Participation Report for corresponding period, (3) CME warehouse ledgers

Analyst reconstructions (not official regulatory figures):

Bear Stearns $2.7B: Widely cited calculation in commodities analysis (attributed to analysts including Ted Butler and others citing CFTC COT data) based on:

Methodology: Reported COMEX position sizes (from COT reports) × price moves December 2007 to March 2008 × estimated margin requirements

Gold component: ~$1.5B (based on ~$200/oz adverse move)

Silver component: ~$1.2B (based on ~$7/oz adverse move)

Critical note: Not found in FCIC Report, SEC filings, or DOJ documents. Official record (Financial Crisis Inquiry Commission, SEC) attributes collapse to subprime mortgage exposure and MBS portfolio losses. Treat as plausible analyst estimate using available COT data, not verified regulatory loss figure.

Analytical interpretations:

CFTC bank concentration (68%): Derived from publicly available Bank Participation Report data analysis, not direct CFTC quote

Basel III impacts: NSFR 85% charge verified; claims of specific “July 2025” reclassifications corrected per LBMA clarifications

Working primary source links:

CFTC Bank Participation Reports: https://www.cftc.gov/MarketReports/BankParticipationReports/index.htm

Basel III NSFR Framework: https://www.bis.org/bcbs/publ/d295.pdf

SEC EDGAR (SLV filings): https://www.sec.gov/cgi-bin/browse-edgar

Bear Stearns collapse analysis: https://www.investopedia.com/articles/07/bear-stearns-crisis.asp

CME Silver Futures: https://www.cmegroup.com/markets/metals/precious/silver.html

Secondary verification sources (DOJ URLs archived/migrated):

JPMorgan, Scotiabank, Merrill Lynch DOJ press releases: Verified via Forbes, Bloomberg, Reuters, Financial Post coverage

CFTC enforcement actions: Some release numbers updated in database migrations; amounts cross-verified

Chinese bank warnings: Reported via Global Times, China Daily; primary disclosures in Mandarin

Methodology: All regulatory settlement amounts verified through minimum two independent sources (court documents, regulatory filings, financial press). Market data cross-referenced across multiple providers. Analyst reconstructions clearly flagged as estimates rather than verified figures. Price data verified against COMEX settlement records and ETF NAV disclosures.

Recommendation for readers: When citing this analysis, distinguish between:

Verified regulatory fines (primary sources available via DOJ/CFTC links in text)

Market data aggregator figures (reliable but require specific date/timestamp verification from primary sources)

Analyst reconstructions (reasonable estimates but not official regulatory figures)

For absolute precision on aggregated figures, verify independently:

JPMorgan positions: SEC EDGAR SLV daily holdings + CFTC Bank Participation Reports for specific December 2025 dates

COMEX inventory: CME Group daily warehouse stock reports December 1–4, 2025

Supply deficits: Silver Institute 2025 World Silver Survey (specific table/page reference)

Solar demand: Silver Institute photovoltaic demand tables (2024–2030 projections)

These primary documents provide timestamped, auditable figures versus aggregated estimates used in this analysis.

This analysis synthesizes publicly available regulatory filings, DOJ settlements, CFTC enforcement actions, and market data through January 2026. Figures represent documented losses and fines; actual proprietary trading losses likely exceed disclosed amounts.

Editorial Note: This article has been fact-checked against primary sources, regulatory records, and market data aggregators. Key revisions:

Timeline corrected: Bank fines ($1.27B) and prison sentences (2023) resulted from 2008–2016 manipulation prosecuted 2016–2025. The 2025 rally happened years after enforcement and represents a separate chapter showing market stress when supply deficits meet a previously manipulated market. Settlement dates (UBS 2025, Goldman 2025) refer to final approval dates for crimes committed years earlier, not events related to the 2025 rally.

Bear Stearns $2.7B figure reclassified as analyst reconstruction (not official regulatory figure)

March 2024 silver price corrected to $24–25/oz (breakout to $30 occurred May 2024)

Basel III claims corrected per LBMA regulatory clarifications

COMEX inventory and JPMorgan position figures qualified as data aggregator estimates requiring timestamped verification

All regulatory fine amounts cross-verified through multiple sources with manipulation periods and enforcement periods clearly distinguished

For questions on methodology or to report corrections: @navnoorquant

About the Analysis

Quantitative research focused on institutional precious metals trading, systematic strategy performance, and regulatory enforcement patterns. For collaboration or questions: @navnoorquant

https://www.youtube.com/@TheMathematicalTrader

📊 Support this research: https://www.patreon.com/c/NavnoorBawa