Bridgewater’s Alpha-Beta Framework: How Risk Parity and Portable Alpha Generate Returns

The mechanics behind systematic macro’s most influential strategies — and their structural failure modes.

This is a detailed research piece. If you find value in institutional-quality hedge fund analysis, support this work on Patreon.

Bridgewater Associates pioneered two frameworks that reshaped institutional portfolio construction: alpha-beta separation (1990) and risk parity (1996). Pure Alpha returned +26.2% YTD through September 2025; All Weather posted +15.3% over the same period. Understanding the P&L mechanics reveals principles applicable across systematic macro.

The Core Insight: Risk Allocation ≠ Dollar Allocation

Traditional 60/40 portfolios concentrate ~90% of risk in equities. Stocks exhibit 4–5x more volatility than bonds — the 40% bond allocation barely moves the needle on portfolio risk.

Bridgewater’s solution: allocate by risk contribution, not dollars. This requires levering low-volatility assets (bonds) to equalize their risk contribution with high-volatility assets (equities).

Strategy 1: All Weather (Risk Parity Beta)

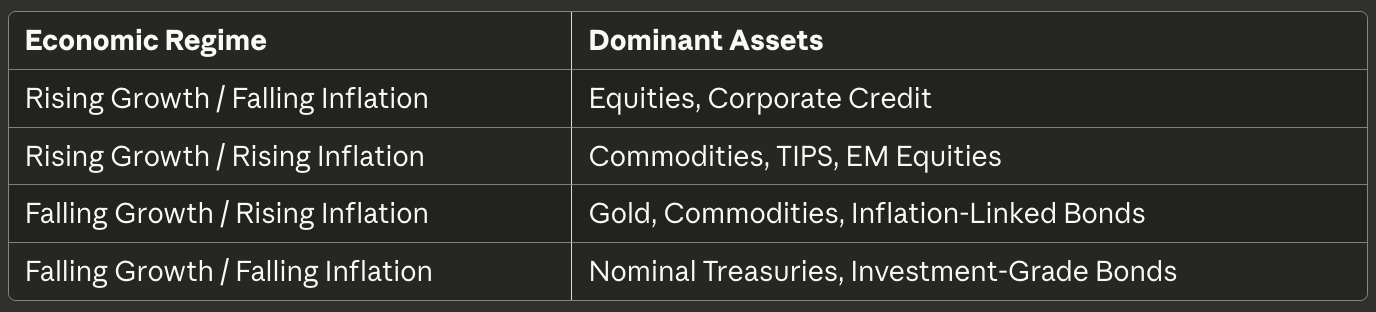

The Four-Quadrant Framework

All Weather equalizes risk across four economic environments:

No forecasting required. Weights adjust dynamically based on rolling volatility estimates — typically trailing 12-month standard deviation.

Implementation & Leverage

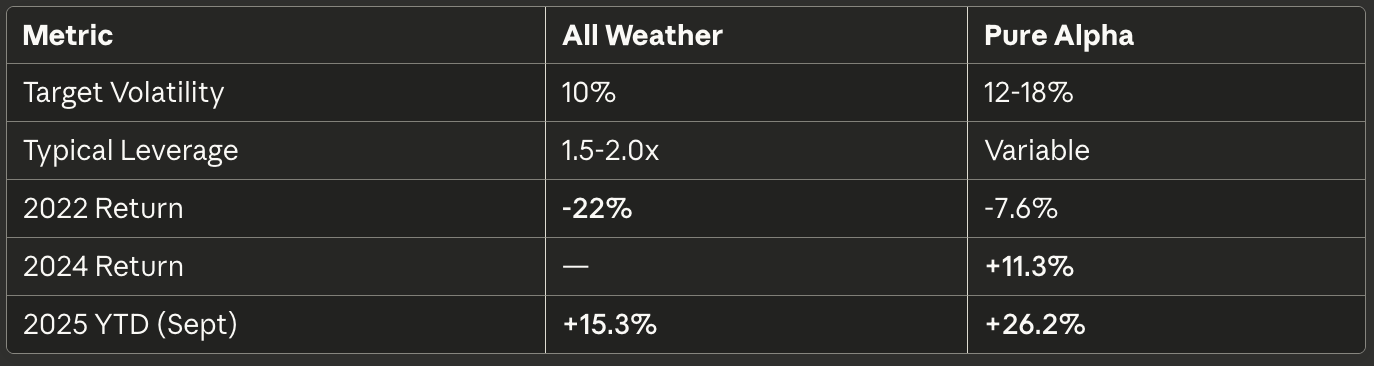

Unlevered risk parity allocates ~47% to bonds, ~19% to equities, and ~34% to commodities by dollar weight. To achieve 10% target volatility (matching traditional 60/40 risk), managers apply 1.5–2.0x leverage via futures, bringing notional exposure to 150–200%.

Instruments:

Equity beta: S&P 500, MSCI World futures

Bond beta: Treasury futures (2Y, 10Y, 30Y), TIPS

Commodity beta: Bloomberg Commodity Index futures, gold

The Leverage Aversion Premium

Risk parity harvests a structural mispricing: most institutional mandates prohibit leverage, forcing capital into high-volatility assets. This bids up equities relative to bonds, creating superior risk-adjusted returns for investors willing to lever low-volatility assets.

2022: When Correlation Breaks the Strategy

All Weather lost 22% in 2022 — its worst drawdown on record. The failure mechanism:

Normal regime: Growth falls → stocks drop → rates cut → bonds rise. Portfolio stable.

2022 stagflation: Inflation rises → rates hiked aggressively → both stocks and bonds drop simultaneously.

Leverage amplifies: With 2x bond exposure, the losses compounded.

Stock-bond correlation spiked to approximately +0.65 in 2022 versus the long-run average of -0.20. The diversification thesis collapsed precisely when it was needed most.

Strategy 2: Pure Alpha (Portable Alpha)

Structure

Pure Alpha runs 30–40 uncorrelated positions across bonds, currencies, equities, and commodities. Target volatility: 12% (Pure Alpha I) or 18% (Pure Alpha II).

Key characteristics:

Global macro: discretionary + systematic hybrid

Alpha overlay capability: active positions layered on client benchmarks

Designed for zero beta to traditional markets

The “Economic Machine” Framework

Bridgewater codifies cause-and-effect relationships into hundreds of “decision rules.” Positions express views on where economies sit within three cycles:

Short-term debt cycle (5–8 years): Credit expansion/contraction

Long-term debt cycle (75–100 years): Secular deleveraging

Productivity growth: Structural economic trends

Portable Alpha Implementation

Institutional investors use Pure Alpha as an overlay:

Beta exposure: Gain S&P 500 via futures (~5% margin requirement)

Alpha deployment: Remaining 95% cash allocated to Pure Alpha

Result: S&P 500 return + Pure Alpha return on the same capital base

This structure explains why capacity matters — alpha is zero-sum.

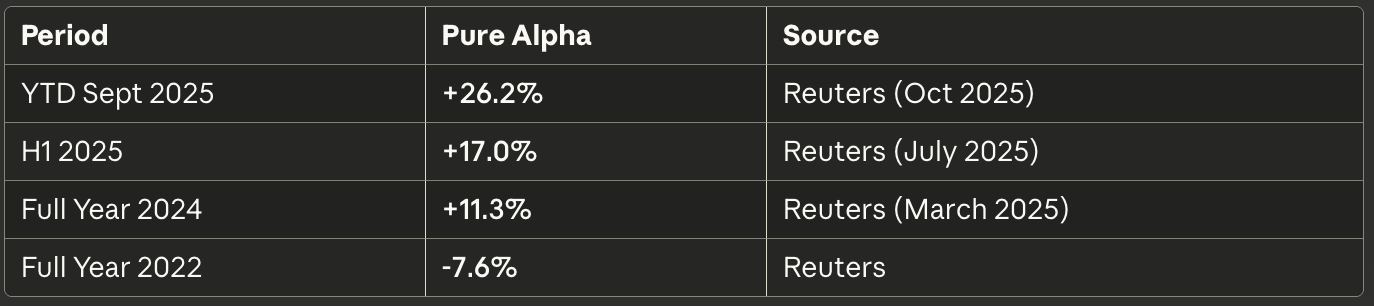

Verified Performance

The 2025 outperformance came from macro volatility driven by U.S. trade policy uncertainty — exactly the dislocated environment where discretionary macro thrives.

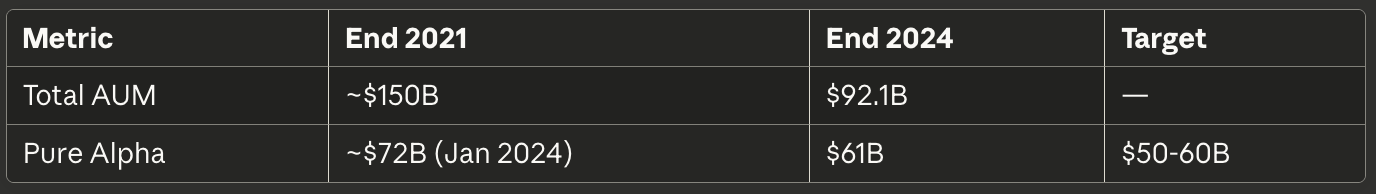

AUM & Capacity Management

Bridgewater deliberately shrank assets to preserve alpha:

Source: Reuters regulatory filing coverage, March 2025

The firm returned capital to clients and limited new inflows. Per Reuters: management’s goal is “to be the best, not the biggest.”

Structural Risks

Risk Parity Vulnerabilities

Correlation regime dependence: The strategy is effectively short correlation volatility. When stock-bond correlation spikes positive, the diversification thesis fails.

Leverage amplification: 2x notional = 2x losses when hedges fail.

Rising rate environments: Bonds (the largest allocation) suffer sustained drawdowns. 2022–2023 proved catastrophic for leveraged duration.

Pure Alpha Vulnerabilities

Capacity constraints: Alpha decays as AUM grows. Large positions move markets.

Framework risk: The “economic machine” reflects specific macro assumptions. Regime changes (e.g., post-2020 monetary policy) may invalidate historical relationships.

Key person transition: Leadership shifted to co-CIOs Karen Karniol-Tambour, Greg Jensen, and Bob Prince. Ray Dalio sold remaining stake in 2025.

Key Metrics Summary

Quant Takeaway

Risk parity is not passive — it’s a short correlation volatility position. Allocating to risk parity means betting the historical negative stock-bond correlation persists. This worked for 40 years of declining rates. Forward-looking, the thesis is less certain.

Pure Alpha demonstrates that alpha-beta separation allows institutions to source uncorrelated returns while maintaining benchmark exposure via derivatives. The portable alpha concept — gaining beta through futures, deploying cash to alpha strategies — remains underutilized outside top-tier allocators.

Verified Sources (Working Links)

Reuters — “Bridgewater’s flagship macro fund Pure Alpha jumps 8.1% in Q3” (Oct 2025) https://www.reuters.com/markets/us/bridgewaters-flagship-macro-fund-pure-alpha-jumps-81-outperforming-market-2025-10-01/

Reuters — “Bridgewater’s flagship Pure Alpha gains 17% in H1” (July 2025) https://www.reuters.com/markets/us/bridgewaters-flagship-pure-alpha-gains-17-h1-source-says-2025-07-01/

Reuters — “Hedge fund Bridgewater’s assets down to $92.1 billion in 2024” (March 2025) https://www.reuters.com/business/finance/hedge-fund-bridgewaters-assets-down-921-billion-2024-2025-03-31/

CAIA Association — “Risk Parity Not Performing? Blame the Weather” (Jan 2024) https://caia.org/blog/2024/01/02/risk-parity-not-performing-blame-weather

Bridgewater Associates — “The All Weather Strategy” (Official) https://www.bridgewater.com/research-and-insights/the-all-weather-strategy

State Street Global Advisors — SPDR Bridgewater All Weather ETF (ALLW) https://www.ssga.com/us/en/intermediary/capabilities/alternatives/all-weather-etf

ETF.com — “All Weather ETF Inspired by Ray Dalio Strategy Debuts” (March 2025) https://www.etf.com/sections/news/all-weather-etf-inspired-ray-dalio-strategy-debuts

Bridgewater Associates — Karen Karniol-Tambour (Co-CIO) https://www.bridgewater.com/people/karen-karniol-tambour

Markov Processes International — Risk Parity Analysis (Dec 2024) https://www.markovprocesses.com/blog/risk-parity-not-performing-blame-the-weather/

Institutional Investor — “Bridgewater Extends Strong Run” (Oct 2025) https://www.institutionalinvestor.com/article/bridgewater-extends-strong-run-gains-across-flagship-and-china-funds

📊 Support this research: https://www.patreon.com/c/NavnoorBawa

This is a masterclass in dissecting the Bridgewater engine—specifically the point that Risk Parity is effectively a short correlation volatility trade. You identified the 2022 failure mode perfectly. However, I think the "Portable Alpha" discussion is where the real future opportunity lies for institutions. While correlation regimes will oscillate, the ability to separate beta maintenance from alpha generation remains structurally sound. The under-discussed risk going forward might be *basis risk* and futures roll costs; if we stay in a regime of elevated rates, the "cheap leverage" assumption that powers the beta replication could face headwinds that correlation models miss. It’s not just about the assets moving together, but the cost of holding the synthetic expsoure.

Such a fantastic post. I worked with Bridgewater in a past life. Very interesting place.